# Insurance Adjuster Route Optimization Software: Cut Claim Processing Time 45%

> TL;DR: Insurance adjuster route optimization software reduces claim processing time by up to 45% through AI-powered routing that eliminates inefficient travel patterns. Insurance adjusters waste 30-40% of their workday driving between claims without proper route planning. Route optimization tools like Zeo Route Planner address this with AI-powered optimization and real-time GPS tracking, helping insurance teams save 2+ hours daily while maintaining complete audit trails for regulatory compliance.

Insurance companies lose thousands of dollars daily to inefficient adjuster routes. Claims managers know the frustration: adjusters spending hours in traffic instead of processing claims, missed deadlines, and mounting operational costs.

The solution lies in insurance adjuster route optimization software that transforms how field teams operate. Modern insurance companies use route optimization to reduce claim processing time by 45% while cutting adjuster travel costs by 35%.

The Hidden Cost of Inefficient Insurance Adjuster Routes: Why Claims Take Too Long

Insurance adjusters waste 30-40% of their workday driving between claim sites. This inefficiency creates a domino effect that impacts every aspect of claims operations.

Consider a typical adjuster handling 8 claims daily across a metropolitan area. Without optimized routing, they might drive 120 miles and spend 4 hours in transit. With proper route optimization, the same claims require just 75 miles and 2.5 hours of driving.

The real costs extend beyond fuel and time. Delayed claim processing leads to regulatory compliance issues, customer dissatisfaction, and increased settlement costs. According to the National Association of Insurance Commissioners, companies face average penalties of $50,000 for missing state-mandated claim resolution deadlines.

Customer satisfaction plummets when adjusters arrive late or reschedule appointments. A delayed property damage claim can escalate from a simple repair to a total loss due to weather exposure or secondary damage. Effective customer retention strategies become critical when service delays threaten policyholder relationships.

Adjuster burnout increases when field teams spend more time navigating traffic than investigating claims. Bureau of Labor Statistics data shows high turnover rates among insurance adjusters, with many citing poor operational support as a primary factor.

Audit trails suffer when adjusters rush between appointments without proper documentation. Incomplete records create compliance risks and potential fraud exposure during regulatory examinations.

Essential Features Every Insurance Adjuster Route Optimization Software Must Have

Effective insurance adjuster route optimization software needs specific capabilities beyond basic GPS navigation. Claims managers should evaluate platforms based on these critical features.

AI-powered route optimization handles complex scheduling constraints insurance companies face daily. The software must account for claim priorities (total loss versus minor damage), time windows for customer availability, and adjuster specializations like commercial property or auto damage.

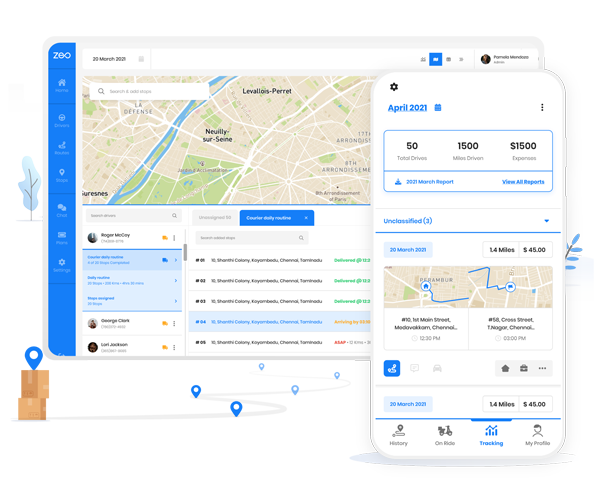

Real-time GPS tracking and live ETA updates keep claims managers informed of field operations through advanced driver tracking software. When adjusters encounter delays, managers can proactively contact customers and adjust schedules. This transparency prevents the cascade effect where one delay disrupts an entire day’s schedule.

Proof of service documentation creates essential audit trails for compliance. Digital signature collection, photo capture, and detailed notes provide the documentation insurance commissioners require during examinations. Modern proof of delivery systems ensure complete record-keeping for every claim visit.

Zeo Route Planner delivers these capabilities through its comprehensive platform. Claims managers use the web interface to assign routes based on adjuster skills and claim priorities, while adjusters receive optimized routes directly on their mobile devices. The AI-powered optimization saves over 2 hours daily per adjuster while maintaining complete documentation trails.

Integration capabilities connect route optimization with existing claims management systems. The software should import claim data automatically and export completion status, eliminating duplicate data entry.

Customer notification systems via SMS and email reduce no-shows and improve satisfaction scores. Customers receive live tracking links showing adjuster location and accurate arrival times.

Analytics and reporting help claims managers identify performance trends and optimize operations. Route efficiency reports, adjuster productivity metrics, and cost savings analysis support continuous improvement initiatives.

ROI Calculator: How Much Your Insurance Company Can Save with Route Optimization

Route optimization delivers measurable returns through reduced operational costs and faster claim resolution. Claims managers can calculate potential savings using specific metrics from their current operations.

Travel cost savings represent the most immediate return. Calculate your current adjuster travel expenses including fuel, vehicle wear, and mileage reimbursements. Route optimization typically reduces miles driven by 25-35%.

For a 20-adjuster team driving 100 miles daily at $0.65 per mile, annual travel costs reach $325,000. A 30% reduction saves $97,500 annually in direct travel expenses alone.

Time savings create additional capacity without hiring new adjusters. Each adjuster saving 2 hours daily can handle 2-3 additional claims, increasing team productivity by 25%.

If your adjusters complete an average of 6 claims daily, time savings from route optimization enable 7.5 claims per day. This productivity increase equals hiring 5 additional adjusters for a 20-person team.

Compliance cost avoidance prevents regulatory penalties. State insurance departments impose fines ranging from $1,000 to $50,000 per violation for missed claim deadlines. Route optimization helps ensure timely claim completion.

Customer retention improvements reduce policy churn costs. McKinsey research shows acquiring new insurance customers costs 5-7 times more than retaining existing policyholders. Better service through timely claims processing directly impacts renewal rates.

Consider a mid-size insurance company with 25 field adjusters:

- Annual travel cost reduction: $120,000

- Productivity increase equivalent: 6 additional adjusters ($480,000 value)

- Compliance penalty avoidance: $25,000 average

- Software cost: $60,000 annually

- Net annual savings: $565,000

Integration Guide: Connecting Route Software with Insurance Management Systems

Successful route optimization requires seamless integration with existing claims management platforms. Claims managers need automated data flow between systems to maximize efficiency gains.

Claims management system integration eliminates manual data entry and ensures accurate information flow. The route optimization software should automatically import new claims with customer addresses, priorities, and required adjuster skills.

increase fuel savings

Hassle Free Deliveries & Pickups!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for Free

Popular integration methods include API connections, CSV file imports, and third-party connector platforms. The best route optimization software solutions integrate with major systems through Zapier, connecting to over 1000 applications including leading claims management platforms.

Customer relationship management (CRM) synchronization maintains updated contact information and communication preferences. When adjusters complete claims, the system should automatically update customer records with service completion data.

Document management system connections ensure proper filing of proof of service documentation. Photos, signatures, and notes collected during field visits should automatically upload to the appropriate claim files.

Implementation timeline typically requires 2-4 weeks for full integration depending on system complexity. Start with a pilot program using 5-10 adjusters to validate workflows before company-wide deployment.

Staff training focuses on mobile app usage for field adjusters and route management for claims supervisors. Most adjusters adapt to optimized routing within 3-5 days of implementation.

Data migration involves transferring frequently visited locations, customer preferences, and historical routing data. This foundation enables immediate optimization benefits rather than requiring weeks of learning algorithms.

Case Study: How Modern Insurance Companies Reduce Claim Processing Time by 45%

Regional insurance company Mountain States Insurance faced mounting pressure from state regulators over claim processing delays. With 35 field adjusters covering a three-state territory, travel inefficiencies prevented timely claim resolution.

The company’s adjusters averaged 3.2 hours daily in transit, completing only 5.5 claims per day. Customer satisfaction scores dropped to 72% due to missed appointments and delayed claim settlements.

Mountain States implemented comprehensive route optimization software with specific focus on insurance industry requirements. The platform optimized daily routes based on claim priorities, customer availability windows, and adjuster specializations.

Results after 90 days:

- Average daily travel time reduced from 3.2 to 1.8 hours

- Claims completed per adjuster increased from 5.5 to 8.2 daily

- Customer satisfaction scores improved to 89%

- Regulatory compliance achieved 98% on-time claim completion

- Annual operational cost reduction of $340,000

The key success factor was treating route optimization as a complete operational transformation rather than just navigation software. Claims managers assigned routes strategically, adjusters received comprehensive mobile tools, and customers gained transparency through live tracking.

Modern fleet management software enabled this transformation by providing both fleet management capabilities for claims supervisors and intuitive mobile apps for field adjusters. The integrated approach delivered the 45% reduction in claim processing time while maintaining audit trails required for regulatory compliance.

Implementation insights:

- Week 1-2: Pilot with 8 adjusters in metro area

- Week 3-4: Full deployment with training program

- Week 5-8: Performance monitoring and optimization

- Week 9-12: Results measurement and process refinement

The company now processes 25% more claims with the same adjuster team while maintaining higher service quality standards.

Frequently Asked Questions

Q: How much time do insurance adjusters typically waste on inefficient routing?

Insurance adjusters waste 30-40% of their workday driving between claim sites without optimized routing. This translates to 2.5-4 hours daily spent in transit rather than processing claims, directly impacting productivity and customer satisfaction.

Q: What compliance risks do insurance companies face with delayed claim processing?

State insurance departments impose fines ranging from $1,000 to $50,000 per violation for missing claim deadlines. Beyond penalties, delayed claims can escalate repair costs, create audit trail gaps, and increase fraud exposure during regulatory examinations.

Q: How does route optimization software integrate with existing claims management systems?

Modern route optimization platforms connect through APIs, CSV imports, or connector services like Zapier. Zeo Route Planner integrates with over 1000 applications, automatically importing claim data and exporting completion status to eliminate duplicate data entry while maintaining audit trails.

Q: What ROI can insurance companies expect from implementing route optimization?

Insurance companies typically see 25-35% reduction in travel costs and 25% productivity increase from route optimization. A 25-adjuster team can save over $500,000 annually through reduced travel expenses, increased claim capacity, and compliance penalty avoidance.

Q: Which features are most critical for insurance adjuster route optimization software?

Essential features include AI-powered optimization for claim priorities, real-time GPS tracking, proof of service documentation with photos and signatures, customer notifications, and integration capabilities. Zeo Route Planner provides these through its comprehensive platform, helping adjusters save over 2 hours daily while maintaining complete documentation trails.

Start your free 7-day trial to see how Zeo can reduce your claim processing time and cut adjuster travel costs.

Are you a fleet owner?

Want to manage your drivers and deliveries easily?

Grow your business effortlessly with Zeo Routes Planner – optimize routes and manage multiple drivers with ease.

increase fuel savings

Save 2 Hours on Deliveries, Everyday!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for Free