# How to Reduce ATM Service Costs: Smart Strategies for Mobile Businesses

Mobile businesses lose thousands of dollars each year to a hidden expense most managers never track: ATM fees. Your drivers and field technicians need cash for COD payments, business expenses, and daily operations. But those $3-5 ATM fees add up fast when you multiply them across your entire fleet.

Learning how to reduce ATM service costs is crucial for mobile businesses looking to improve their bottom line. The good news? Strategic planning can eliminate 80-90% of these costs without changing how your business operates. Here’s how to reduce ATM service costs through smarter routing and cash management.

The Hidden Cost of ATM Fees for Mobile Businesses: Why $3 Transactions Cost You Thousands

ATM fees seem small until you do the math. A delivery driver making three ATM visits per week pays $468 annually in fees alone. Scale that across ten drivers, and you’re looking at $4,680 in unnecessary expenses. According to Federal Reserve data on ATM fees, the average out-of-network ATM fee has risen consistently, making this an increasingly expensive problem for businesses.

The problem gets worse with cash-heavy operations. Food delivery services, pest control companies, and HVAC technicians often need multiple cash transactions daily. One pool cleaning company with 15 technicians discovered they were spending over $8,000 annually on ATM fees.

These costs hide in expense reports and petty cash receipts. Most business owners never realize the true impact until they start tracking every transaction. The average mobile worker visits ATMs 2-4 times per week, with fees ranging from $2.50 at out-of-network ATMs to $6.00 at convenience store machines.

Consider the ripple effects beyond direct fees. Workers waste time driving to multiple ATMs when they can’t find fee-free options. They make unplanned stops that delay customer appointments. Some avoid cash transactions entirely, potentially losing COD sales.

Smart Route Planning: Building Daily Routes Around Fee-Free ATM Networks

The solution starts with understanding your local banking landscape. Every major bank offers fee-free ATMs, but they’re scattered across different locations. Your job is mapping these networks and building routes that naturally include fee-free stops.

Start by identifying which banks your employees use. Create a master list of fee-free ATM locations within your service area. Most banks provide online locators that show every fee-free machine in your region.

Plot these locations on your service map alongside customer addresses. Look for clusters where fee-free ATMs sit near multiple customer locations. These become anchor points for your daily routes.

When building routes, prioritize stops that pass fee-free ATM locations during natural travel patterns. A technician heading from downtown to suburban appointments can stop at their bank’s branch ATM without adding significant travel time. Fleet management software can help automate this process by incorporating multiple stop types into efficient route plans.

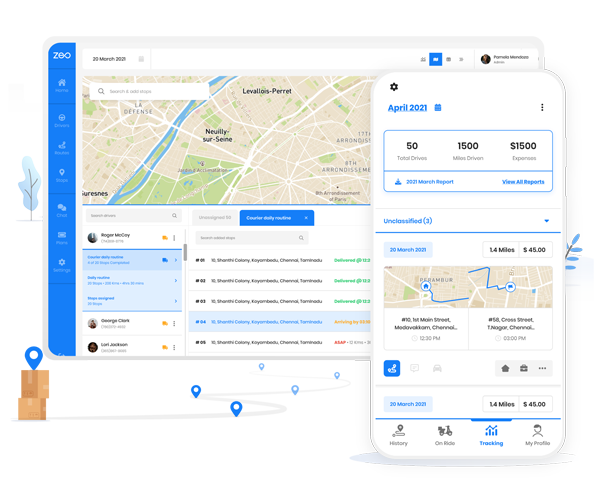

Your drivers can use the Zeo mobile app to see their optimized routes that include planned fee-free ATM stops, and receive notifications when they’re near partner bank locations during their daily routes. This eliminates guesswork and ensures they never pay unnecessary fees.

Time these stops strategically. Schedule ATM visits early in routes when drivers need cash for COD deliveries. Plan afternoon stops when workers need to deposit cash or grab money for the next day’s expenses.

Cash Management Strategies for Field Teams: Reducing ATM Dependencies Through Better Planning

Smart cash management reduces how often your team needs ATMs in the first place. Start with better cash flow planning. Analyze your typical cash needs by worker and route type. Field service management principles can help establish systematic approaches to cash handling across your operations.

Establish daily cash floats for workers who handle regular COD transactions. A delivery driver might start each day with $200 in small bills, reducing mid-route ATM needs. Service technicians could carry $100 for emergency supplies or parking fees.

Implement a cash recycling system where workers deposit large bills and keep smaller denominations for change-making. This reduces both ATM visits and the need to break large bills at customer locations.

Partner with customers to reduce cash dependencies. Encourage electronic payments through mobile card readers or digital invoicing. Offer small discounts for credit card payments to offset processing fees while eliminating ATM costs.

Create petty cash policies that minimize emergency withdrawals. Stock vehicles with enough cash for typical daily expenses like parking meters, small supply purchases, or meal allowances during long routes. The Small Business Administration offers comprehensive cash management guidelines that can help establish these policies.

Consider corporate banking solutions. Some banks offer business accounts with extensive fee-free ATM networks or reimburse ATM fees up to certain monthly limits. The annual account fees often cost less than accumulated ATM charges.

Technology Solutions: Route Optimization Tools That Factor in Banking Locations

Modern route optimization goes beyond finding the shortest path between customers. Advanced tools can factor in banking locations, operating hours, and cash requirements when building daily routes.

Route optimization software like Zeo can incorporate multiple stop types into efficient daily plans. Add fee-free ATM locations as potential stops, and the system will include them only when they improve overall route efficiency.

Set up location-based alerts that notify drivers when they’re near fee-free ATMs. This prevents missed opportunities when workers pass their bank branches during regular routes.

Use driver tracking software to analyze where your team currently makes ATM stops. You might discover patterns showing workers consistently visiting expensive ATMs near certain customer clusters. This data helps you find better fee-free alternatives in those areas.

Integrate banking information into your dispatch system. When assigning cash-heavy routes, prioritize drivers whose banks have convenient fee-free locations along the planned path.

Mobile apps can store personalized banking information for each worker. Drivers see their specific fee-free options without sorting through locations for banks they don’t use.

Implementation Guide: Training Your Mobile Workforce on Cost-Effective Cash Access

Success depends on getting your team to change established habits. Start with education about the real costs. Show workers how ATM fees affect both company expenses and their own reimbursements.

Create simple reference guides showing fee-free ATM locations within your service area. Organize these by geographic zones or common route patterns. Laminated route cards or mobile app bookmarks make this information easily accessible.

Establish clear cash management policies. Define when workers should use ATMs versus when they should manage with existing cash. Set spending thresholds that trigger different cash-seeking behaviors.

increase fuel savings

Save $200 on fuel, Monthly!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for Free

Train workers to plan cash needs during route reviews. Before starting daily routes, drivers should estimate cash requirements and identify the best fee-free ATM stops along their path.

Implement expense reporting that tracks ATM fees separately. This creates visibility and accountability while helping you identify workers who need additional coaching.

Recognize and reward fee-conscious behavior. Celebrate teams or individuals who significantly reduce ATM expenses. Share success stories that demonstrate effective cash management strategies.

Address resistance to change directly. Some workers prefer familiar ATM locations even when they charge fees. Explain how route optimization and fee reduction benefit everyone through improved profitability and job security.

ROI Calculator: Annual Savings from Strategic ATM Cost Management

Calculate your potential savings using these benchmarks. Start with current ATM usage patterns across your mobile workforce. Bureau of Labor Statistics data on mobile workers shows consistent growth in field service employment, making cost optimization increasingly important.

Average mobile worker ATM usage:

- 3 visits per week at $4 average fee = $624 annually per worker

- Peak usage workers: 5 visits per week = $1,040 annually

- Light usage workers: 1 visit per week = $208 annually

Multiply by your workforce size for total annual ATM expenses. A 20-person mobile team averages $12,480 in annual ATM fees under typical usage patterns.

Strategic route planning typically eliminates 80-90% of these fees. Using the conservative 80% reduction rate:

- 20-person team saves: $9,984 annually

- 50-person team saves: $24,960 annually

Add indirect savings from reduced travel time and improved route efficiency. Workers spend an average of 8 minutes per unplanned ATM stop, including travel and transaction time.

Reducing three weekly ATM stops saves 24 minutes per worker per week, or 20.8 hours annually. At $25/hour fully loaded labor costs, each worker saves $520 in productivity time.

Combined savings for a 20-person team:

- ATM fee reduction: $9,984

- Productivity improvement: $10,400

- Total annual savings: $20,384

Implementation costs are minimal. Route optimization software subscriptions typically cost $20-40 per user monthly, easily justified by ATM fee savings alone. Learn more about how to reduce logistics costs across your entire operation.

Frequently Asked Questions

Q: What are the main strategies to reduce ATM service costs for mobile businesses?

The most effective strategies include strategic route planning around fee-free ATM networks, implementing better cash management systems, and using technology solutions to optimize banking stops. Companies typically reduce ATM costs by 80-90% through these combined approaches.

Q: How much money can a mobile business save by optimizing ATM usage?

A typical 20-person mobile team can save nearly $20,000 annually by combining ATM fee reduction ($9,984) with productivity improvements ($10,400). Zeo Route Planner helps achieve these savings by incorporating fee-free ATM locations into optimized daily routes, eliminating unnecessary detours and delays.

Q: Which banks offer the best fee-free ATM networks for business users?

Major banks like Chase, Bank of America, Wells Fargo, and regional credit unions typically offer extensive fee-free ATM networks. The best choice depends on your service area coverage, with some banks offering business accounts that reimburse ATM fees up to monthly limits.

Q: How can route optimization software help reduce banking costs?

Route optimization software can incorporate fee-free ATM locations as planned stops within daily routes, set up location-based alerts when drivers pass their banks, and analyze current ATM usage patterns to identify cost-saving opportunities. Zeo Route Planner specifically allows businesses to add banking stops to optimized routes without compromising efficiency.

Q: What cash management practices reduce the need for frequent ATM visits?

Effective practices include establishing daily cash floats for workers, implementing cash recycling systems, encouraging electronic payments, and creating petty cash policies for daily expenses. These strategies can reduce ATM visits from 3 times weekly to once weekly or less.

Start Reducing ATM Costs Today

ATM fees represent one of the easiest expenses to eliminate from mobile operations. Strategic route planning, better cash management, and worker education can reduce these costs by 80-90% within the first month of implementation.

The key is treating ATM access as a routing consideration, not an afterthought. When you build routes that naturally include fee-free banking stops, workers get the cash they need without paying unnecessary fees.

See how Zeo’s route optimization can help you plan efficient routes that include fee-free ATM stops – start your free trial today. Take control of these hidden costs and put thousands of dollars back into your business operations where they belong.

Are you a fleet owner?

Want to manage your drivers and deliveries easily?

Grow your business effortlessly with Zeo Routes Planner – optimize routes and manage multiple drivers with ease.

increase fuel savings

Hassle Free Deliveries & Pickups!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for Free