The world of banking logistics is on the brink of a major shift, and 2025 is set to be a game-changing year. Banking logistics trends will bring faster, smarter, and more efficient systems driving everything from secure document delivery to critical cash transfers.

But here’s the catch, if you’re not ready to embrace the banking logistics trends shaping the future, you risk falling behind. The industry is evolving fast, and the pressure is on for banks to keep up.

Whether it’s optimizing routes or leveraging real-time data, these trends are transforming logistics in ways that will reshape the way banking logistics operate.

Let’s dive into banking logistics trends that will define the future of banking in 2025.

Top Seven Banking Logistics Trends to Look Out for in 2025

Adapt or fall behind – this is the reality for leaders as they face a future brimming with opportunities and banking logistics trends. Embracing these trends isn’t just an option; it’s a necessity for staying competitive in an ever-demanding market.

- AI-driven Routing Tools for Asset Transit

With rising demand for efficient and secure transport of high-value items, route optimization has become a cornerstone of modern banking logistics. The fastest route makes the safest route!AI-driven routing tools optimize routes and ensure seamless operations. In 2025, banks that adopt these technologies will not only reduce operational costs but also enhance customer trust by maintaining service continuity.

- Dynamic ATM Cash Replenishment

Static replenishment schedules are giving way to dynamic models driven by real-time data. Predictive analytics and route optimization allow banks to adapt instantly to fluctuating cash demands, reducing downtime and ensuring uninterrupted service.By 2025, institutions embracing this trend will gain a significant edge, ensuring customer satisfaction while minimizing unnecessary transit and operational inefficiencies.

- Integration of AI and Analytics

AI and predictive analytics are revolutionizing how banks manage logistics. By analyzing patterns, these technologies forecast demand, anticipate risks, and enable smarter resource allocation.In 2025, route analytics will play a vital role in reducing inefficiencies and ensuring proactive responses to supply chain challenges. For banking logistics, leveraging AI will be key to achieving precision and resilience in an increasingly dynamic environment.

- Real-Time Visibility Across Operations

Transparency across the supply chain is becoming non-negotiable in banking logistics. Advanced tracking systems provide real-time insights into vehicle locations, delivery statuses, and potential disruptions.Businesses that adopt real-time visibility tools in the near future will enhance operational efficiency and build stronger trust with customers and stakeholders through seamless communication and accountability.

- Sustainability Through Electrification

Environmental responsibility is now a business imperative. Banking logistics is aligning with global sustainability goals through the adoption of electric vehicles (EVs) for transportation.Route planners tailored for EV logistics enable efficient planning with integrated charging stops, ensuring seamless operations while reducing the carbon footprint. Banks adopting sustainable practices in their logistics will improve public perception in 2025.

- Enhanced Security Through Intelligent Routing

In an era of heightened risks, banking logistics demands smarter approaches to safety. Route planners equipped with real-time monitoring and secure routing capabilities help banks avoid high-risk zones while ensuring asset safety.increase fuel savings

Save $200 on fuel, Monthly!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for FreeThe integration of AI in route planning will be pivotal in safeguarding cash, sensitive documents, and other valuables, making security a key competitive differentiator.

- Last-Mile Delivery Precision

The last mile in banking logistics, whether it’s delivering cash, financial cards, statements, or sensitive documents, is under transformation. Innovations in routing and delivery tools are enabling precise, on-time deliveries that enhance customer experience.By adopting these innovations, banks can boost customer satisfaction and streamline operations, a critical factor in maintaining relevance in 2025’s competitive landscape.

Why Having a Route Planner is Non-Negotiable for Banking Logistics

With the growing complexity of modern banking logistics, dealing with sensitive materials, fluctuating demand, and increasing customer expectations, businesses simply cannot afford to operate without a reliable, efficient system in place. A route planner isn’t just an added benefit; it’s a necessity.

For banking logistics, traditional methods or manual routing can no longer keep up with the demands of the industry. Routing mistakes, delays, or inefficiencies can lead to costly disruptions, security breaches, or worse – lost customer trust.

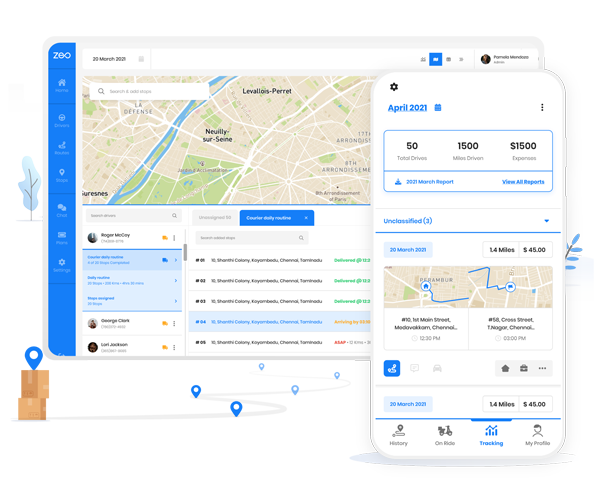

This is where a robust route planner like Zeo becomes non-negotiable. By optimizing routes in real-time and offering full visibility into operations, Zeo helps ensure that every delivery reaches its destination securely and on time.

Here’s how Zeo’s features align with the unique needs of banking logistics:

- Route Optimization

Optimize delivery routes to ensure timely delivery of sensitive financial assets including cash and documents.

- Live Tracking

Monitor vehicles in real-time to enhance security and provide stakeholders with complete transparency.

- Automated Delivery Updates

Keep banks, ATMs, and other stakeholders informed with accurate ETAs, reducing uncertainty and improving trust.

- Proof of Delivery

Capture digital signatures and photos for secure verification of deliveries like confidential documents or cash.

- Driver Management

Assign tasks efficiently and track driver performance to maintain seamless operations across multiple locations.

- Data-Driven Analytics

Analyze logistics performance to uncover inefficiencies and enhance future planning for cost savings.

The Final Word

With the trends we’ve highlighted and the tools available, embracing advanced solutions like Zeo Route Planner is key to driving efficiency, enhancing security, and ensuring timely, reliable deliveries. If you’re ready to transform your banking logistics operations and optimize your routes for maximum impact, Zeo is the partner you need.

Don’t let your banking logistics fall behind. Schedule a demo with our experts today and discover how Zeo can revolutionize your logistics management.

Let’s make your banking logistics more secure, efficient, and future-ready!

Are you a fleet owner?

Want to manage your drivers and deliveries easily?

Grow your business effortlessly with Zeo Routes Planner – optimize routes and manage multiple drivers with ease.

increase fuel savings

Save 2 Hours on Deliveries, Everyday!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for Free