Updated on: February 9, 2026

Reading Time: 6 minutes

TL;DR: Managing cash on delivery orders requires setting order limits, tracking payments accurately, and maintaining clear customer communication throughout the delivery process. Successful COD management can reduce order rejections by up to 30% when proper tracking systems are in place. Route optimization tools like Zeo Route Planner address this with COD tracking and real-time GPS tracking, helping delivery teams save 2+ hours daily.

An increasing number of customers are taking advantage of home deliveries! So naturally, businesses are doing everything they can to make the experience convenient for the customers.

One way is to offer multiple payment options so that the customer can choose the one that suits them best. Some customers prefer the cash-on-delivery payment method as it doesn’t need them to share sensitive banking information. It also makes it easier to buy from a new website as the customers don’t risk losing their money.

Read ahead to understand why a business should offer cash-on-delivery, what are its challenges, and how a business can manage it best!

Why should you be offering a cash-on-delivery payment option?

- It helps in widening the customer base and includes people who don’t have a credit card or don’t want to use it for online shopping.

- It enables impulse purchases as the customers don’t need to fill in payment details. It allows for faster checkout.

- With the rise in e-commerce websites, customers have become cautious, and rightly so as some fraudulent websites have also popped up. However, with cash on delivery as a payment option, the customer has no fear of losing money. It lowers the barrier for new customers to try your products or services.

The Growing Importance of COD in Modern Commerce

According to the U.S. Census Bureau’s retail trade data, e-commerce continues to grow rapidly, with delivery services becoming increasingly crucial for customer satisfaction. Cash on delivery remains a vital payment option, particularly for businesses serving diverse demographic groups and expanding into new markets.

The flexibility of COD payment methods has become even more critical as businesses adapt to changing consumer preferences. Companies that offer multiple payment options, including COD, typically see higher conversion rates and broader market reach compared to those limiting payment methods.

Challenges of cash on delivery to businesses:

- It leads to higher-order rejections. As the customer has not yet paid, they can reject the product on delivery if they’ve changed their mind. This adds to the cost of reverse logistics hampering profitability. Managing the inventory also becomes a challenge with higher rejections.

- Managing the collection of cash especially when there’s a high volume of small-value orders is cumbersome. It becomes even more tricky if a third party is handling your deliveries. Transferring the cash to your account may take a few days whereas in the case of online payments, money gets transferred instantly.

- Cash handling security risks increase when drivers carry significant amounts of cash throughout their routes, requiring additional safety protocols and insurance considerations.

- Reconciliation complexity grows with volume, as businesses must match collected payments with delivered orders across multiple drivers and routes daily.

Advanced Strategies for COD Order Management

8 ways to manage cash on delivery orders:

- Set minimum and maximum order value limits

Setting the order value limits ensures that your business doesn’t end up incurring reverse logistics costs for numerous low-value orders. It incentivizes the customer to purchase more to avail of COD which is a win-win for both the customer and the business. Having a cap on the maximum order value lowers the risk for high-value items. - Charge a small fee for COD orders

Charging a fee for COD orders pushes the customer to consider online payments. Even if the customer goes ahead with COD, this fee will help you cover the cost in case of rejection. However, it should be a small amount so that the customer doesn’t end up abandoning the cart. - Check customer history

In case of repeat customers, you can embed codes on your website to check the customer history. If the history shows instances of rejections, then those customers won’t be eligible for the COD payment option. This helps in filtering out the customers so that good customers still enjoy the benefits of COD and business losses are minimized. - Customer communication

Keep the customer updated about the delivery of their orders with accurate ETA. This ensures that the customer is available to receive the orders and order delivery is not failed. If the customer doesn’t know when the delivery is going to happen then they may miss the delivery. It will add to the costs of taking back the package, storing it, and then making another delivery attempt. - Adherence to delivery promise

Nothing frustrates a customer more than delayed deliveries. Ensure adherence to the delivery duration promised to the customer. If the delivery is delayed, inform the customer about the reason for the delay. According to Department of Transportation supply chain research, consistent delivery performance significantly impacts customer retention and reduces order cancellations. - Enabling electronic payments for COD orders

Offer the customer the option to make online payments even at the time of delivery. It will be useful in case the customer doesn’t have the required cash to hand over to the delivery person. They can make the payment with their card after inspecting the order items. - Implement route optimization for COD efficiency

Optimize delivery routes to minimize the time drivers spend on the road with collected cash. Efficient routing reduces security risks and allows for faster cash deposits. Strategic route planning also helps drivers maintain better schedules for COD appointments. - Establish clear COD collection protocols

Create standardized procedures for drivers to follow when collecting COD payments, including verification steps, receipt documentation, and secure cash storage methods during their routes.

Read more: Revolutionize Customer Communication with Zeo’s Direct Messaging Feature

Technology Solutions for COD Management

Modern delivery management requires sophisticated tracking and communication systems to handle COD orders effectively. Digital solutions help businesses maintain transparency, reduce errors, and improve customer satisfaction throughout the COD process.

The integration of route optimization with payment tracking creates a comprehensive system that addresses both operational efficiency and financial accountability. For businesses handling multiple COD deliveries daily, these technological solutions become essential for maintaining profitability and customer trust.

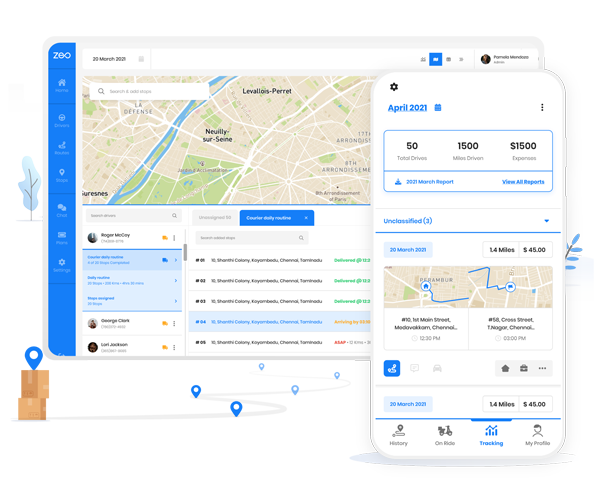

How Zeo helps in managing COD orders?

As a fleet manager using Zeo Route Planner, you can enable the drivers to collect payments at the time of delivery. It’s simple and helps you keep track of the COD payments as everything gets recorded in the driver app.

increase fuel savings

Hassle Free Deliveries & Pickups!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for Free

It provides greater clarity and visibility into the collection of payments. It helps in easier reconciliation of cash when the delivery drivers hand it over. It streamlines the completion of COD orders.

- In the fleet owner dashboard, you can go to Settings → Preferences → POD Payments → Click on ‘Enabled’.

- On reaching the customer’s address, the delivery driver can click ‘Capture POD’ in the driver app. Within that click on the ‘Collect Payment’ option.

- There are 3 options to record the collection of payment – Cash, Online, and Pay Later.

- If the payment is being made in cash, the delivery driver can record the amount in the app. If it’s an online payment, they can record the transaction ID and also capture an image. In case, the customer wants to pay later, the driver can record any notes along with it.

Learn about efficient route planning strategies in our Step-by-Step Sales Route Optimization Guide and discover how proper scheduling impacts delivery success in our AI Delivery Management Software guide.

Hop on a 30-minute demo call for hassle-free COD deliveries via Zeo Route Planner!

Frequently Asked Questions

What are the main risks of offering cash on delivery to customers?

The primary risks include higher order rejection rates (typically 15-25% higher than prepaid orders), increased reverse logistics costs, and cash handling security concerns for drivers. Additionally, businesses face delayed cash flow since payments aren’t collected until delivery, and there’s potential for fraud or non-payment situations.

How can businesses reduce COD order cancellations and rejections?

Implement order value limits, maintain clear communication with accurate delivery ETAs, and establish customer history tracking to identify unreliable buyers. Charging a small COD fee and offering alternative payment options at delivery also help reduce rejection rates significantly.

What’s the optimal COD fee to charge without losing customers?

Most successful businesses charge 1-3% of the order value or a flat fee of $2-5, depending on their market and average order size. The fee should cover potential reverse logistics costs while remaining low enough not to discourage customers from completing purchases.

How do delivery management systems help with COD tracking?

Route optimization platforms like Zeo Route Planner streamline COD management through integrated payment collection features, real-time tracking of cash collections, and automated reconciliation systems. These tools help businesses serving 150+ countries maintain accurate financial records while optimizing delivery efficiency.

What documentation should drivers maintain for COD orders?

Drivers should capture proof of delivery with photos, collect digital signatures, record exact payment amounts, and document any special circumstances or customer notes. This documentation protects both the business and customer while enabling proper financial reconciliation and dispute resolution.

Conclusion

E-commerce businesses can not operate without offering cash on delivery orders. It is best to implement technology and control systems to ensure that COD works in the favor of both the customers and the businesses.

Are you a fleet owner?

Want to manage your drivers and deliveries easily?

Grow your business effortlessly with Zeo Routes Planner – optimize routes and manage multiple drivers with ease.

increase fuel savings

Save $200 on fuel, Monthly!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for Free