Updated on: July 21, 2025

In banking logistics, every minute counts, and the safe, efficient movement of high-value assets is critical. From ensuring timely cash replenishments at ATMs to transporting sensitive documents between branches, financial institutions rely on precise and reliable logistics.

But managing these operations manually or with outdated systems can lead to delays, increased costs, and potential security risks.

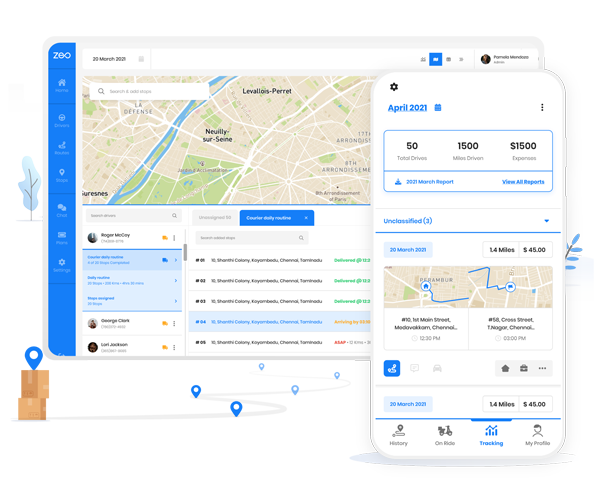

Enter Zeo’s fleet management solutions – designed specifically to address the unique challenges of banking logistics. With Zeo, banks can streamline their operations, enhance security, and ensure that every delivery is on time and compliant, all while optimizing costs and improving efficiency.

How Zeo Route Planner Streamlines Fleet Management

Zeo’s fleet management solutions are built with the complexities of banking logistics in mind. Here’s how its powerful features enhance operations in this highly regulated and high-stakes industry:

-

Live Route Tracking

Real-time tracking is essential for financial institutions handling valuable assets like cash, documents, and other high-value goods. Zeo’s live route tracking ensures that bank-owned vehicles are always monitored throughout their routes.

With this feature, banks can have full visibility into the delivery process, ensuring that assets are on track, on time, and within safe areas. This level of transparency helps prevent theft, delays, and unauthorized deviations.

Real-time updates can also be shared with stakeholders, adding an additional layer of confidence for customers.

-

Route Optimization

Time-sensitive deliveries are a cornerstone of banking logistics. ATM replenishments, inter-branch transfers, and cash deliveries all require prompt and precise timing. Zeo’s route optimization feature minimizes delays by calculating the fastest and safest routes.

By dynamically adjusting delivery routes based on the most current data, Zeo helps ensure that every delivery arrives on time, boosting customer satisfaction while also improving fuel efficiency and reducing vehicle wear-and-tear.

-

Driver Management

Managing a fleet of drivers efficiently is critical to banking logistics. With Zeo, banks can easily assign drivers to specific tasks, monitor their performance, and ensure compliance with safety standards and company protocols.

The system tracks driver behavior, provides performance analytics, and gives management the ability to review driving habits.

This data not only improves operational efficiency but also helps identify top performers and those who may need additional training, ultimately enhancing the overall quality of service provided by the logistics team.

-

Automated Delivery Updates

For banks, timely and accurate updates are crucial to maintain transparency and customer trust. Zeo’s automated delivery updates ensure that stakeholders are informed in real time, whether it’s a scheduled cash drop or the delivery of sensitive documents.

increase fuel savings

Save $200 on fuel, Monthly!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for FreeAutomated alerts provide clients with delivery status updates, estimated arrival times, and immediate notifications in case of delays. This proactive communication enhances the customer experience by keeping them in the loop at every stage of the delivery process.

-

Collect Proof of Delivery

In the banking sector, maintaining accurate records of asset transfers is non-negotiable. Zeo’s system allows drivers to capture digital proof of delivery (POD) at each drop-off, which can be securely stored and accessed later.

This feature is invaluable for financial institutions needing to document every transaction for compliance and auditing purposes. Not only does this streamline the documentation process, but it also helps prevent disputes and inaccuracies in asset tracking, ensuring that all transfers are well-recorded and properly validated.

-

Route Analytics

Data-driven decision-making is essential in banking logistics to improve performance and reduce costs. Zeo’s route analytics feature compiles data from all routes taken, providing insights into delivery times, and other areas that may require further optimization.

By analyzing this data, banks can pinpoint inefficiencies, identify recurring delays, and adjust routes accordingly. This continual analysis allows banking logistics managers to refine their processes, reduce operational costs, and enhance overall performance.

-

Mobile App for Drivers

With Zeo’s mobile app for drivers, managing deliveries becomes more seamless and intuitive. Drivers can access route details, proof of delivery, and real-time traffic updates directly from their phones.

The app allows for instant communication with the logistics team, enabling swift problem-solving if issues arise. It ensures that drivers are always prepared with the latest instructions, making each delivery process smoother, faster, and more secure.

For the banking sector, this efficiency is crucial to maintaining a consistent and reliable service, especially during peak periods or high-demand situations.

Conclusion

Zeo is a transformative tool for banking logistics, bringing precision, security, and efficiency to every step of the process. With real-time tracking, route optimization, and intelligent fleet management, Zeo empowers financial institutions to streamline their operations, reduce costs, and ensure timely deliveries.

Its robust features not only improve day-to-day logistics but also provide long-term growth benefits, giving banks a competitive edge.

Ready to see how Zeo can optimize your banking logistics? Schedule a demo today and unlock a smarter way to manage your fleet.

Are you a fleet owner?

Want to manage your drivers and deliveries easily?

Grow your business effortlessly with Zeo Routes Planner – optimize routes and manage multiple drivers with ease.

increase fuel savings

Hassle Free Deliveries & Pickups!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for Free