Updated on: July 21, 2025

Banking logistics is the silent backbone of the financial industry, ensuring that cash, documents, and high-value assets move securely and efficiently between branches, ATMs, and vaults. In an industry where trust and reliability are paramount, the stakes couldn’t be higher.

A single delay or oversight can disrupt operations, breach customer trust, and even result in financial losses. This is where route optimization transforms banking logistics.

Key Challenges in Banking Logistics

Banking logistics isn’t your average delivery operation. It requires a level of precision, security, and compliance that few industries demand. Here are the five critical challenges faced by financial institutions:

- Ensuring Asset Security

Transporting high-value cash and assets across locations is inherently risky. Threats like theft, vandalism, or even natural disasters can jeopardize the safety of these assets. Security protocols often require planned routes to minimize risk exposure and avoid high-crime areas.

If delivery routes are not optimized, drivers take longer routes that might increase the security threats. Without a robust system like a route planner, banks are left vulnerable to these threats, making asset protection a significant challenge in banking logistics.

- Managing Strict Time Windows

Time is of the essence in banking logistics. ATMs need timely cash replenishments to meet customer demands, and inter-branch transfers often operate on tight schedules. Even a minor delay can cascade into customer dissatisfaction and operational inefficiencies.

Navigating these strict time windows becomes almost impossible without real-time route optimization.

- Compliance with Regulatory Standards

The financial industry operates under stringent regulations, including documentation of asset transfers, secure transportation protocols, and route tracking. Failure to meet these requirements can lead to fines, reputational damage, or worse.

Route optimization tools ensure every step of the journey is documented and compliant, reducing the burden of regulatory oversight.

- Minimizing Operational Costs

Balancing operational efficiency with cost control is a persistent challenge. Fuel expenses, vehicle maintenance, and labor hours can quickly spiral out of control without proper planning.

For banking logistics, where margins are tight, optimized routes are crucial to ensuring minimal wastage and maximum savings.

How Route Optimization is Different in Banking Logistics

Unlike general logistics, where speed and efficiency might be the primary focus, banking logistics demands heightened attention to security, reliability, and compliance.

- Security First: Banking logistics prioritizes asset safety. Route optimization tools for this industry must factor in crime-prone areas, safe stops, and secure handling protocols.

- Time Sensitivity: Unlike traditional deliveries, banking operations have stricter time constraints, such as ATM replenishment deadlines or inter-branch cash transfers that cannot be delayed.

- Compliance Integration: Banking logistics often requires detailed records of routes, stops, and times.

Benefits of Route Optimization in Banking Logistics

Route optimization is crucial for security, cost management, and customer satisfaction. It offers a strategic advantage that transforms challenges into opportunities for growth and reliability.

- Enhanced Security

Route optimization enhances security by meticulously planning routes that reduce travel time. This ensures that vehicles carrying high-value cash and sensitive documents are less exposed to routes that take longer.

increase fuel savings

Hassle Free Deliveries & Pickups!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for FreeAdditionally, the system can recommend alternative routes in case of emergencies, providing an extra layer of protection.

- Improved Time Management

Time-sensitive operations like ATM replenishments or inter-branch cash transfers demand precision. Route optimization takes into account different factors like number of stops, vehicle capacity, driver availability and other variables to ensure timely arrivals.

This minimizes the risk of disruptions caused by delays, enhancing operational efficiency. By meeting critical deadlines consistently, banks can maintain their reputation for reliability and keep customer satisfaction high.

- Reduced Operational Costs

Cost efficiency is a major concern for financial institutions managing logistics. Route optimization minimizes unnecessary mileage, which directly lowers fuel consumption and reduces vehicle wear and tear.

Additionally, optimized routes lead to fewer delays, cutting down on overtime wages and improving overall resource utilization. Over time, these cost savings accumulate, allowing banks to reinvest in other critical areas of their business.

- Regulatory Compliance Made Simple

Banking logistics operates under strict regulatory oversight, requiring detailed records of asset movements. Route optimization tools automate the tracking and documentation process, creating comprehensive logs for each trip.

This not only ensures compliance with regulatory standards but also reduces the administrative burden on staff. By minimizing human error in record-keeping, banks can avoid costly fines and maintain their operational integrity.

- Higher Customer Satisfaction

Customer trust is paramount in the banking industry, and reliable logistics play a key role in maintaining it. Route optimization ensures timely and consistent deliveries, whether it’s cash for ATMs or critical documents for clients.

Meeting or exceeding expectations strengthens customer confidence and reinforces the bank’s reputation. Satisfied customers are more likely to stay loyal, which translates into long-term business success.

- Scalability and Flexibility

As banking operations expand, managing logistics becomes increasingly complex. Route optimization systems are designed to scale effortlessly, handling increased volumes and more complex routes without compromising efficiency.

Whether managing a small fleet or a large-scale operation, these tools provide the flexibility to adapt to changing demands. This ensures that as banks grow, their logistics operations remain seamless and efficient.

Conclusion

In the high-stakes world of banking logistics, where every minute and every decision matters, route optimization isn’t just an operational tool, it’s a competitive advantage. It addresses the core challenges of security, compliance, and efficiency while driving down costs and enhancing customer trust.

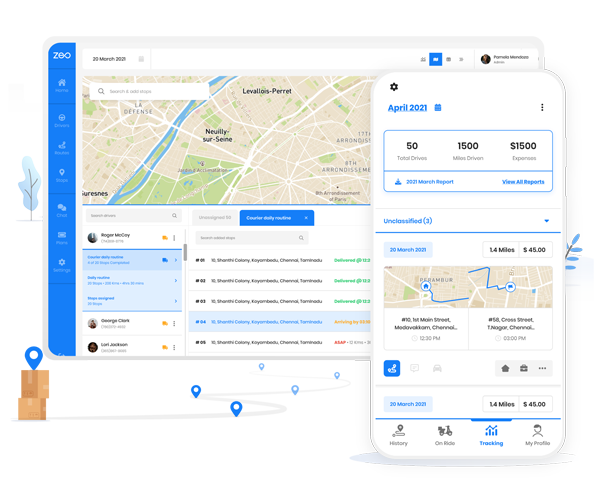

With a platform like Zeo Route Planner, financial institutions can harness the full potential of route optimization. From route optimization and real-time tracking to route analytics, Zeo transforms logistics into a seamless, secure, and efficient operation.

Ready to elevate your banking logistics strategy? Schedule a demo with Zeo today and see the difference for yourself.

Are you a fleet owner?

Want to manage your drivers and deliveries easily?

Grow your business effortlessly with Zeo Routes Planner – optimize routes and manage multiple drivers with ease.

increase fuel savings

Save $200 on fuel, Monthly!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for Free