Updated on: January 25, 2025

As the banking sector becomes more fast-paced and security-driven, fleet managers are faced with the challenge of managing logistics that ensure the safe and timely delivery of sensitive financial assets.

With the rise of digital banking and the need for faster, more secure services, banking logistics requires a strategic approach to keep operations running smoothly. Fleet managers must implement well-thought-out strategies to maximize efficiency while upholding the highest security standards.

Fleet managers need to enhance banking logistics, ensuring both operational success and client trust. They need strategies powered by innovative technology and route optimization that are crucial in transforming how financial institutions manage their logistics needs.

Proven Strategies to Optimize Banking Logistics Efficiency

Efficient banking logistics require fleet managers to adopt strategies that enhance security and streamline routing operations. Here are the key strategies that will help fleet managers transform their banking logistics into a more reliable and efficient operation.

-

Secure Sensitive Banking Routes with Advanced Route Planning

For fleet managers, planning the right route for high-security deliveries is critical. Sensitive banking logistics require meticulous planning, particularly when transporting valuable assets like cash and confidential documents.

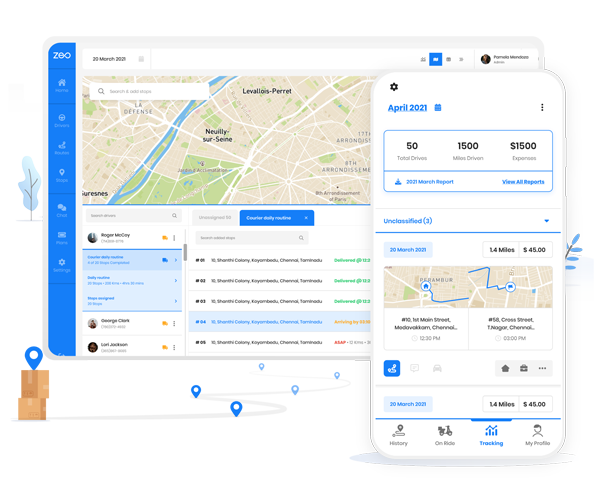

By adopting advanced route planning and route optimization tools, managers can identify the fastest routes that minimize potential risks. Route optimization ensures that vehicles avoid high-risk areas, such as those prone to traffic congestion or accidents, and prioritize high-security zones, like banks, ATMs, and vaults.

By using advanced route planning systems, fleet managers can proactively address security concerns, reduce the chances of theft or mishap, and enhance operational efficiency.

-

Enhance Financial Asset Security with Real-Time Fleet Tracking

Security is at the core of banking logistics, and fleet managers must keep a vigilant eye on the location and condition of assets in transit. Real-time route tracking technology allows managers to monitor deliveries at every stage, providing live updates on the status of shipments.

This feature is especially important when transporting large amounts of cash or confidential documents, ensuring that vehicles are always within the designated safety perimeter.

Real-time tracking also facilitates quick responses in emergencies. If a vehicle deviates from its route or faces unforeseen delays, managers can reroute the driver instantly to avoid disruptions.

This heightened visibility not only ensures the safety of the delivery but also builds confidence with banking stakeholders, as clients will appreciate knowing that the process is transparent and secure.

-

Optimize Multi-Stop Cash and Document Deliveries

For banking logistics, many deliveries involve multiple stops, often across various bank branches, ATMs, or client locations. Fleet managers must optimize multi-stop delivery routes to ensure that each delivery is completed efficiently.

With the help of route planners, managers can create optimized delivery routes that take into account the best paths to minimize drive time while ensuring timely arrivals at each stop.

Effective route optimization for multi-stop deliveries significantly reduces operational costs by minimizing fuel consumption and vehicle wear.

It also ensures that deliveries are completed on time, which is crucial for maintaining customer satisfaction and avoiding delays that could impact financial operations. Fleet managers who master this strategy can enhance efficiency and stay ahead in an increasingly competitive market.

-

Boost Stakeholder Confidence with Automated Delivery Updates

Fleet managers can enhance stakeholder confidence by implementing automated delivery updates, ensuring that both customers and bank officials are kept informed of the progress in real-time.

increase fuel savings

Save 2 Hours on Deliveries, Everyday!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for FreeAutomated updates provide accurate delivery timelines and status changes, allowing stakeholders to track deliveries without needing to contact fleet managers.

This strategy not only builds trust with clients but also ensures that internal teams, such as bank staff, are prepared for the arrival of deliveries. By keeping everyone informed, banking logistics operations become smoother, reducing the risk of service disruptions and enabling better planning at all touchpoints.

-

Ensure Financial Compliance with Digital Proof of Delivery

The banking industry is heavily regulated, with strict compliance requirements surrounding the handling and transportation of financial assets.

Fleet managers must ensure that all deliveries are securely documented, providing proof of delivery that complies with industry regulations. Digital proof of delivery, including electronic signatures and photo verification, offers a secure and auditable record of every transaction.

By leveraging digital proof of delivery, fleet managers can streamline the documentation process and avoid potential compliance issues. This technology reduces the risk of fraud and errors, providing a level of transparency that clients expect from financial institutions.

-

Empower Drivers with Mobile Route Planner

Empowered drivers are key to effective banking logistics. Fleet managers can equip drivers with a mobile route planner to ensure that they have real-time access to optimized routes, traffic updates, and any changes to their delivery schedules.

With a mobile route planner, drivers are able to follow the most efficient routes and also communicate directly with dispatchers and managers in case of any emergencies or delays.

This tool improves driver performance by providing them with all necessary information in one place, enhancing productivity, reducing confusion, and enabling faster decision-making. By integrating mobile route planners into their operations, fleet managers can ensure that drivers have the resources they need to complete their tasks efficiently and securely.

Conclusion:

In the fast-paced and high-stakes world of banking logistics, efficiency, security, and compliance are paramount. Fleet managers can maximize the performance of their logistics operations by adopting strategies that optimize routes, enhance communication, and improve overall security.

By implementing these strategies, banking logistics operations can stay ahead of challenges and meet the growing expectations of clients and stakeholders.

To truly enhance these operations, investing in a robust route planner that integrates advanced features like route optimization, real-time tracking, multi-stop planning, and mobile accessibility is key.

Zeo Route Planner provides all these capabilities, helping banking logistics managers streamline operations, improve efficiency, and ensure secure deliveries. With Zeo, you can stay ahead of the competition and deliver the reliability and precision your stakeholders expect.

So, what are you waiting for? Schedule a free demo with Zeo experts now and experience a redefined efficiency in your banking logistics.

Are you a fleet owner?

Want to manage your drivers and deliveries easily?

Grow your business effortlessly with Zeo Routes Planner – optimize routes and manage multiple drivers with ease.

increase fuel savings

Save $200 on fuel, Monthly!

Optimize routes with our algorithm, reducing travel time and costs efficiently.

Get Started for Free